Tax Rates

|

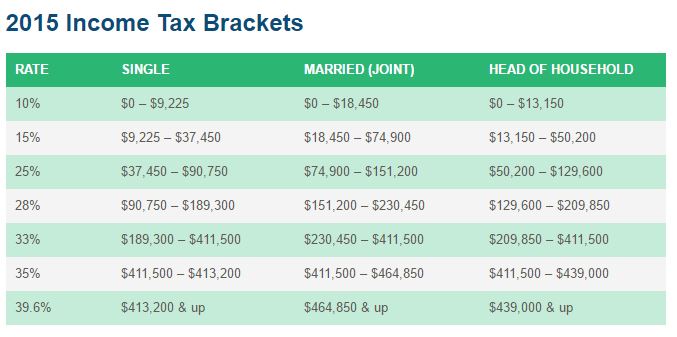

Below are charts showing federal income tax brackets, or marginal tax rates, per the United States tax code for 2016, 2015, and 2014. The 2016 tax brackets apply to money earned in 2016 and for taxes filed in 2017.

Note: The dollar figures in these tables refer to your taxable income, not your total income. Your taxable income is your income after certain deductions have been subtracted. You can find your taxable income on line 43 your 1040 tax return form. These income tax brackets dictate how much federal income tax you will pay when you file your tax returns next April. Remember that these are marginal tax rates which means that the highest rate applies only to money you earn above and beyond the upper limit of the lower rate. |

|